6 Major UAE Changes Every Resident & Business Must Know in 2026

The UAE is entering a new regulatory era in 2026. These reforms are not cosmetic — they directly impact business operations, taxation, digital security, marketing activity, environmental compliance, and daily life.

Whether you are a business owner, freelancer, content creator, investor, or UAE resident, understanding these changes early is critical to avoid penalties and remain compliant.

AFFINITAS DMCC breaks down the six most important UAE reforms coming into force in 2026, what they mean, and how to prepare.

Overview: UAE Regulatory Shift in 2026

| Area | Change | Effective Date |

|---|---|---|

| Digital Tax | Mandatory e-invoicing (XML) | July 2026 |

| Media & Marketing | Influencer/advertiser licence | Deadline Jan 31, 2026 |

| Banking Security | SMS & email OTPs removed | By March 2026 |

| Environment | Nationwide single-use plastics ban | Jan 1, 2026 |

| Excise Tax | New sugary drink tax model | Jan 1, 2026 |

| VAT | Simplified VAT rules | Jan 1, 2026 |

1. Mandatory E-Invoicing & Penalties (Up to AED 5,000)

From July 2026, the UAE will enforce mandatory e-invoicing under a structured digital tax model.

What this means:

- Invoices must be issued electronically

- Standardised XML format

- Integrated with VAT & corporate tax systems

- Manual PDFs will no longer be sufficient

Penalties:

| Violation | Penalty |

|---|---|

| No e-invoicing system | Up to AED 5,000/month |

| Missing invoice / credit note | AED 100 per document |

| System failure not reported | Daily penalties |

| Data manipulation | Severe administrative action |

🔗 Authority:

Federal Tax Authority (FTA)

2. Content Creators Must Obtain Advertiser Licence

Any individual promoting, reviewing, or advertising products or services must hold a valid UAE Advertiser / Influencer Licence.

Key facts:

- Applies to paid and unpaid content

- Required for Instagram, TikTok, YouTube, blogs

- Valid for 1 year

- First 3 years are free

- Deadline extended to 31 January 2026

🔗 Authority:

UAE Media Council

Who is affected:

✔ Influencers

✔ Bloggers

✔ Coaches

✔ Freelancers

✔ Business owners marketing their services

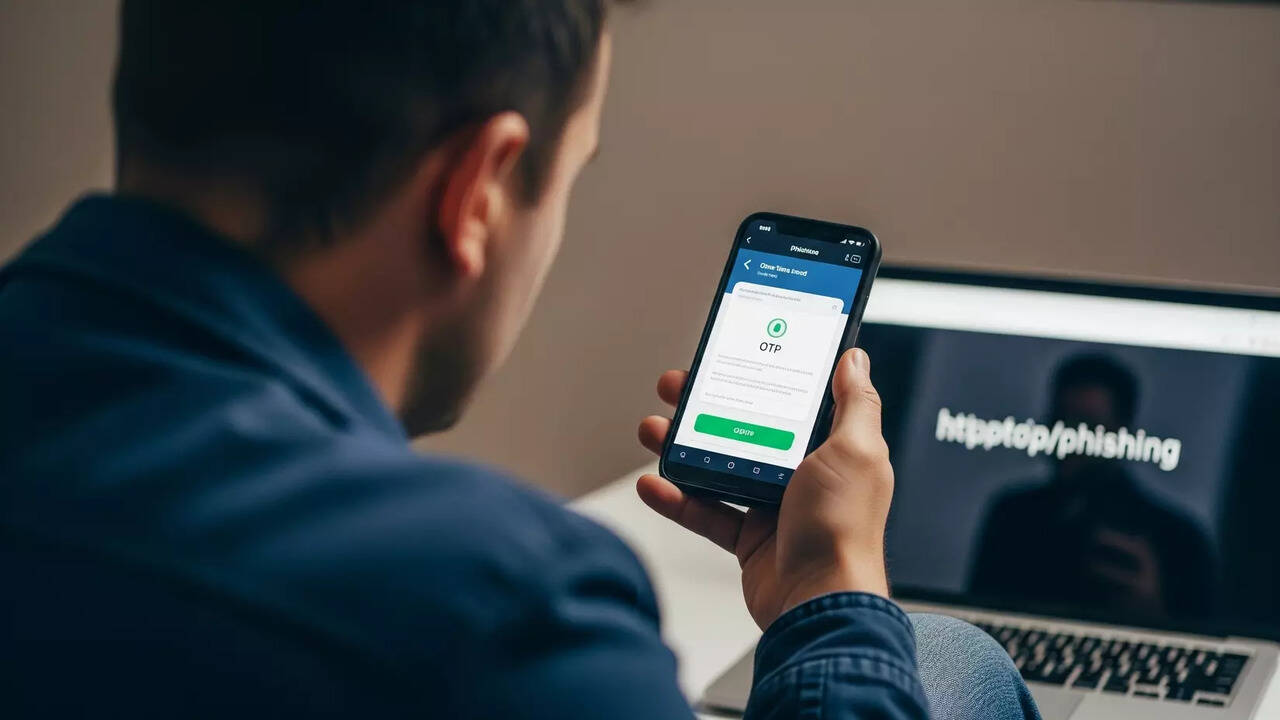

3. Banks to Phase Out SMS & Email OTPs

By March 2026, UAE banks will eliminate SMS and email OTPs.

What replaces them:

- In-app authentication

- Secure biometric ID verification

- Device-based approval systems

Why it matters:

| Benefit | Impact |

|---|---|

| Reduced fraud | Protection from SIM-swap attacks |

| Stronger security | Less phishing |

| Faster approvals | Seamless banking experience |

🔗 Authority:

Central Bank of the UAE

4. Nationwide Ban on Single-Use Plastics

From 1 January 2026, the UAE will ban importing, producing, and trading single-use plastic items.

Banned items include:

- Plastic cups with lids

- Cutlery

- Plates

- Food containers

Impacted sectors:

- Restaurants & cafés

- Retail & food delivery

- Import/export companies

- Events & hospitality

🔗 Source:

UAE Government Portal

5. New Sugary Drink Tax (Tiered System)

From January 1, 2026, the UAE will update excise tax rules for sugary drinks.

What changes:

- Flat 50% excise tax is replaced

- Tiered taxation based on sugar content

- Higher sugar = higher tax

Why this matters:

✔ Encourages healthier products

✔ Aligns with GCC tax model

✔ Impacts manufacturers & importers

🔗 Source:

Ministry of Finance

6. Updated VAT Rules for Businesses

A new federal decree effective January 1, 2026 simplifies VAT compliance.

Key VAT updates:

- ❌ No more self-invoices under reverse charge

- ✔ Normal supporting documents only

- ⏳ New 5-year limit to claim refundable VAT

Business impact:

| Area | Change |

|---|---|

| Accounting | Simplified records |

| Audits | Clearer documentation |

| Refunds | Strict claim timelines |

🔗 Authority:

FTA VAT Guide

How AFFINITAS DMCC Helps You Stay Compliant

AFFINITAS DMCC provides full compliance support across all 2026 reforms, including:

✔ E-invoicing readiness & system audits

✔ VAT & excise tax advisory

✔ Corporate tax alignment

✔ Media & influencer licensing support

✔ Accounting & compliance outsourcing

✔ Business restructuring & advisory

We support Mainland, Free Zone, Offshore & International structures.

FAQs – UAE Changes 2026

❓ Is e-invoicing mandatory for all businesses?

Yes. All VAT-registered businesses must comply from July 2026.

❓ Do small influencers need a licence?

Yes. Even unpaid promotional content requires licensing.

❓ Will plastic bans apply to Free Zones?

Yes. Nationwide ban applies across all emirates and zones.

❓ Are Free Zone companies affected by VAT changes?

Yes. VAT rules apply equally; exemptions are limited and conditional.

❓ Will penalties apply immediately in 2026?

Yes. Most changes include active enforcement, not grace periods.

Final Thoughts

2026 marks a turning point in UAE regulation — digital, transparent, secure, and environmentally aligned with global standards.

📌 Businesses that prepare early will avoid penalties

📌 Late compliance will result in operational and financial risk

AFFINITAS DMCC ensures you are not just compliant — but future-ready.

📞 Contact AFFINITAS DMCC

Launch Your Business In Dubai and the Entire UAE

Get Your Free Consultation with Our Business Consultants

📍 Fortune Tower, Jumeirah Lake Towers – Dubai

📞 +971 (0) 4 576 2903

📧 in*******@af***********.com

🔗 https://affinitasdmcc.com/contact/