A New Millionaire Arrives in the UAE Every Hour: Why Global Wealth Is Moving to Dubai and Abu Dhabi

The United Arab Emirates is no longer just attracting capital — it is absorbing global wealth at an unprecedented pace.

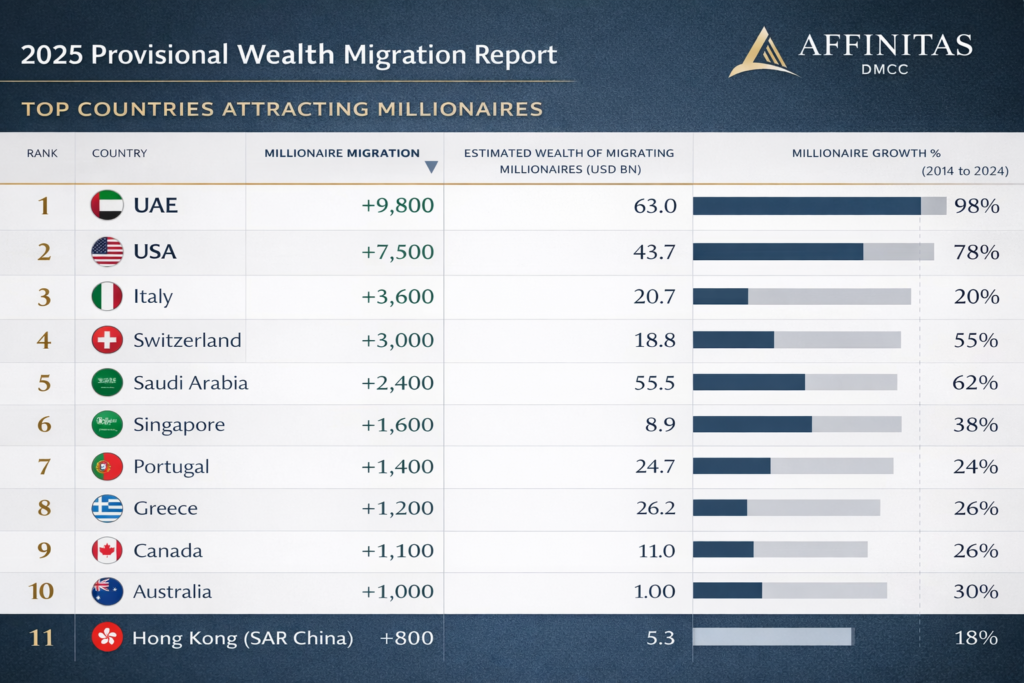

According to the Henley Private Wealth Migration Report 2025, the UAE is expected to welcome 9,800 new millionaires this year alone, equivalent to nearly one new high-net-worth individual every hour. This marks the third consecutive year the UAE has ranked number one globally for net millionaire inflows.

For investors, business owners, and international families, this is not a lifestyle trend — it is a structural shift in how and where wealth is protected, structured, and grown.

$63 Billion in Private Wealth Is Relocating to the UAE in One Year

Henley estimates that approximately $63 billion in private wealth moved into the UAE in 2025. This capital migration is being driven by a combination of:

- Predictable tax policy

- Long-term residency options

- Regulatory clarity

- Political and economic stability

- World-class infrastructure and banking

Unlike speculative inflows, this is deliberate, long-term capital relocation — often involving entire families, operating businesses, holding companies, and investment vehicles.

Why the UAE Is Winning the Global Wealth Migration Race

The UAE’s appeal is structural, not temporary.

Key Drivers of Wealth Migration

- 0% personal income tax

- No inheritance or capital gains tax

- Competitive 9% corporate tax, with lawful structuring options

- Extensive double-tax treaty network

- Stable currency and banking system

- Golden Visa and long-term residency programs

- Pro-business regulation and fast decision-making

This framework explains why the UAE is increasingly chosen not just as a place to live, but as a base for global wealth management and business operations.

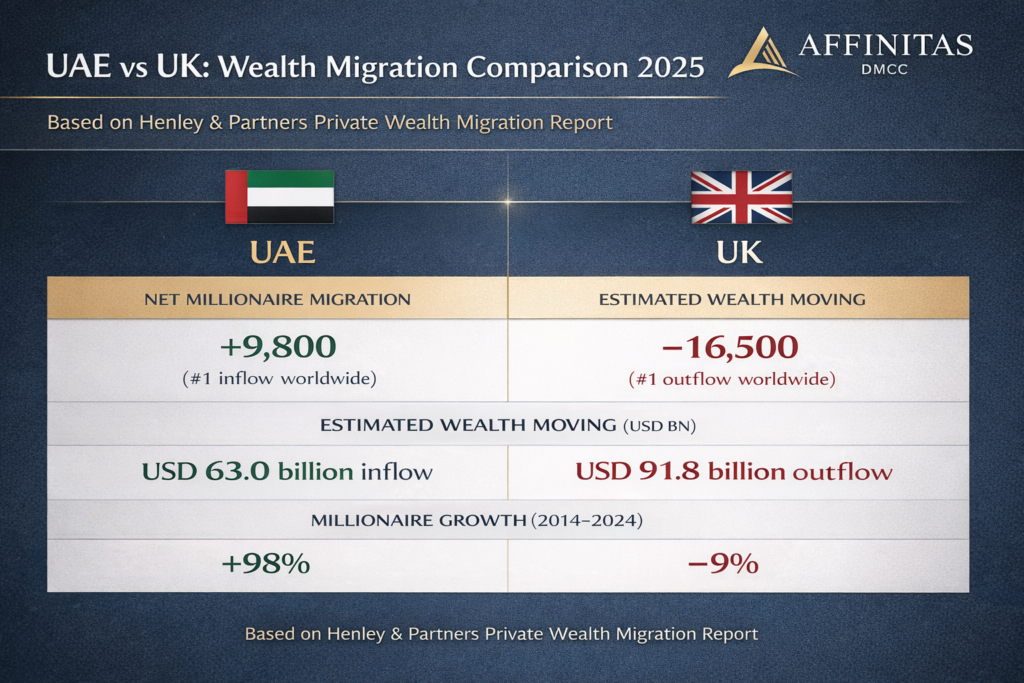

The UK Exodus: “Millionaire Brexit” Accelerates

One of the largest sources of inbound wealth is the United Kingdom, where recent tax reforms have triggered a record outflow of high-net-worth individuals.

Key drivers include:

- Abolition of the Non-Domiciled (Non-Dom) regime

- Higher inheritance and capital gains taxes

- Regulatory uncertainty

- Reduced predictability for long-term wealth planning

In 2025 alone, the UK is projected to lose 16,500 millionaires, making it the world’s largest net exporter of private wealth.

For many, the UAE offers a clear alternative: tax certainty, residency security, and global connectivity.

Not Just Individuals: Businesses, Family Offices & Funds Are Moving Too

The migration is not limited to private individuals.

According to Henley and market data:

- Family offices are establishing UAE headquarters

- Hedge funds and asset managers are relocating operations

- Startups and scale-ups are choosing Dubai and Abu Dhabi as global bases

- Multinationals are shifting regional or global HQs to the UAE

This has accelerated demand for:

- Holding companies

- SPVs and asset-protection structures

- Redomiciliation of existing entities

- Cross-border tax and compliance advisory

Why Millionaires Choose Dubai and Abu Dhabi Specifically

Beyond tax, the UAE offers a complete ecosystem for wealthy individuals and international entrepreneurs.

Lifestyle & Infrastructure Advantages

- Global air connectivity

- International schools and universities

- World-class healthcare

- Secure legal environment

- High quality of life

- Safe, family-friendly cities

Combined with business advantages, this makes the UAE one of the few jurisdictions where wealth, lifestyle, and compliance coexist.

Wealth Migration and the New Compliance Reality

It is important to note:

The UAE is not a “no-rules” jurisdiction.

As wealth inflows increase, so does regulatory sophistication:

- Corporate tax compliance is mandatory

- Transfer pricing rules apply

- Economic substance requirements are enforced

- Free Zone benefits are conditional

- Transparency standards align with OECD frameworks

This has significantly increased the importance of professional structuring and advisory support.

UAE vs UK: Wealth Migration Comparison (2025)

1️⃣ Net Millionaire Migration (2025)

| Country | Net Millionaire Migration |

|---|---|

| UAE | +9,800 (largest inflow globally) |

| UK | −16,500 (largest outflow globally) |

- The UAE is the #1 destination worldwide for high-net-worth individuals (HNWIs).

- The UK is the #1 country losing millionaires in 2025.

Estimated Wealth Moving (USD)

| Country | Estimated Wealth Flow |

|---|---|

| UAE | USD 63.0 billion inflow |

| UK | USD 91.8 billion outflow |

Interpretation:

- The UAE is attracting massive capital, not just people.

- The UK is experiencing a significant capital drain, the largest in the dataset.

Millionaire Growth Trend (2014–2024)

| Country | Millionaire Growth % |

|---|---|

| UAE | +98% |

| UK | −9% |

UAE is winning because of:

- Territorial tax system

- Competitive personal and corporate taxation

- Golden Visa & long-term residency

- Business-friendly regulation

- Political and economic stability

- Wealth protection & succession planning opportunities

UK is losing because of:

- Rising tax pressure on HNWIs

- Changes to non-domiciled tax rules

- Regulatory uncertainty

- Inheritance and wealth taxes

- Capital flight concerns

Key Takeaway

The UAE is not just attracting people — it is absorbing global wealth.

The UK is not just losing residents — it is exporting capital.

This shift explains:

- Surge in UK → UAE relocations

- Growth in family offices, holding companies, SPVs

- Rising demand for tax restructuring, redomiciliation, Golden Visa advisory

UAE vs Traditional Wealth Destinations

| Factor | UAE | UK / EU |

|---|---|---|

| Personal income tax | 0% | Up to 45% |

| Inheritance tax | 0% | Up to 40% |

| Regulatory predictability | High | Declining |

| Capital mobility | High | Restricted |

| Business setup speed | Fast | Slow |

This comparison explains why the UAE continues to absorb global wealth while other markets see capital flight.

What This Means for Investors and Business Owners in 2026

For high-net-worth individuals and entrepreneurs, the current trend signals:

- Early positioning advantages still exist

- Demand for compliant structures is rising

- Banking and residency planning must be strategic

- Long-term structuring matters more than short-term tax savings

The UAE is evolving into a mature wealth jurisdiction, not a temporary refuge.

How Affinitas DMCC Supports Wealth Migration to the UAE

Affinitas DMCC works with international clients to:

- Structure wealth compliantly in the UAE

- Establish holding companies and SPVs

- Redomicile existing businesses

- Navigate corporate tax and reporting

- Align residency, business, and investment strategies

One Millionaire Per Hour Is a Signal

The fact that a new millionaire settles in the UAE nearly every hour is not coincidence — it is confirmation.

It confirms:

- Global confidence in the UAE

- A shift away from legacy financial centers

- A new geography of wealth and capital

For investors and businesses, the question is no longer why the UAE — but how to structure the move correctly.

Plan Your UAE Wealth & Business Strategy

Launch Your Business in Dubai and the Entire UAE

Get Your Free Consultation with Our Business Consultants

📞 +971 (0) 4 576 2903

📧 in*******@af***********.com

📍 Fortune Tower, Jumeirah Lake Towers — Dubai

🔗 https://affinitasdmcc.com/contact/